When you’re in the market for a mortgage, it’s important to work with a loan officer you can trust. Here are a few things to look for when choosing a loan officer:

They should be licensed and insured.

When you’re looking for a mortgage, it’s essential to work with a loan officer who is licensed and insured. This ensures that you are protected if something goes wrong during the lending process. It’s important to have peace of mind when making such a significant financial decision.

They should have experience in the mortgage industry.

A good loan officer should have experience in the mortgage industry. This experience will help them guide you through the process and help you get the best mortgage for your needs.

They will know the ins and outs of the mortgage process and be able to help you navigate through any potential bumps in the road. Working with an experienced loan officer is a great way to ensure a smooth mortgage process.

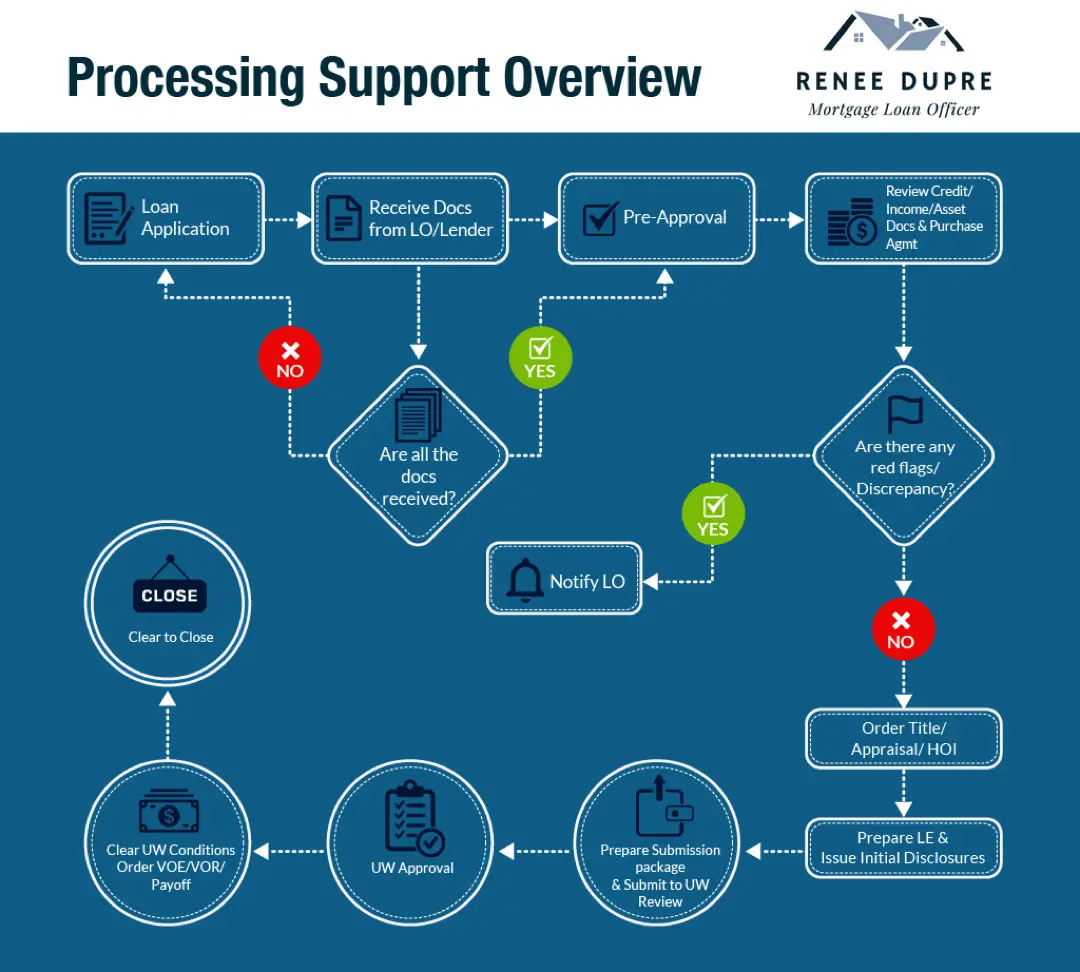

They should have a good understanding of the loan process.

A good loan officer will have a good understanding of the loan process. This means they will be able to explain the process to you in a way that is easy to understand. They should also be able to answer any questions you have about the loan process.

Our next thing to look for in a mortgage loan officer is, you guessed it, they should be able to answer any questions you have.

They should be able to answer all of your questions.

A good loan officer should be able to answer all of your questions about the mortgage process. They should be knowledgeable and helpful. If you have any concerns, they should be able to address them.

They should be available when you need them.

A good loan officer should be available when you need them. This means they should be easy to get in touch with and quickly respond to your questions. You shouldn’t have to wait days or weeks for a response.

After all, the mortgage process can be time-sensitive. You don’t want to miss out on a great opportunity because your loan officer wasn’t available.

They should be able to provide references.

A good loan officer should be able to provide you with references from past clients. These references can give you an idea of what it’s like to work with the loan officer, and whether or not they’re someone you can trust.

After all, you’re trusting them with one of the most significant financial decisions you’ll ever make. It’s important to feel confident in your choice of a loan officer.

They should have a good reputation.

When you’re looking for a loan officer, check their reputation. You can do this by asking around or checking online reviews. A good loan officer will have a good reputation in the industry.

They should be able to offer a variety of mortgage products.

A good loan officer should be able to offer a variety of mortgage products. This will allow you to find the best mortgage for your needs.

They should have a range of products available, from conventional mortgages to government-backed mortgages. They should also be able to offer refinancing options in case you need to adjust your mortgage later on.

Here are some examples:

- Construction and Lot Loans

- Conventional Housing Loans

- FHA Housing Loans

- Jumbo Mortgages

- Mobile Home Loans

- Reverse Mortgages

- Rural Housing Loans

- VA Home Loans

By offering various mortgage products, a loan officer can help you find the best mortgage for your needs.

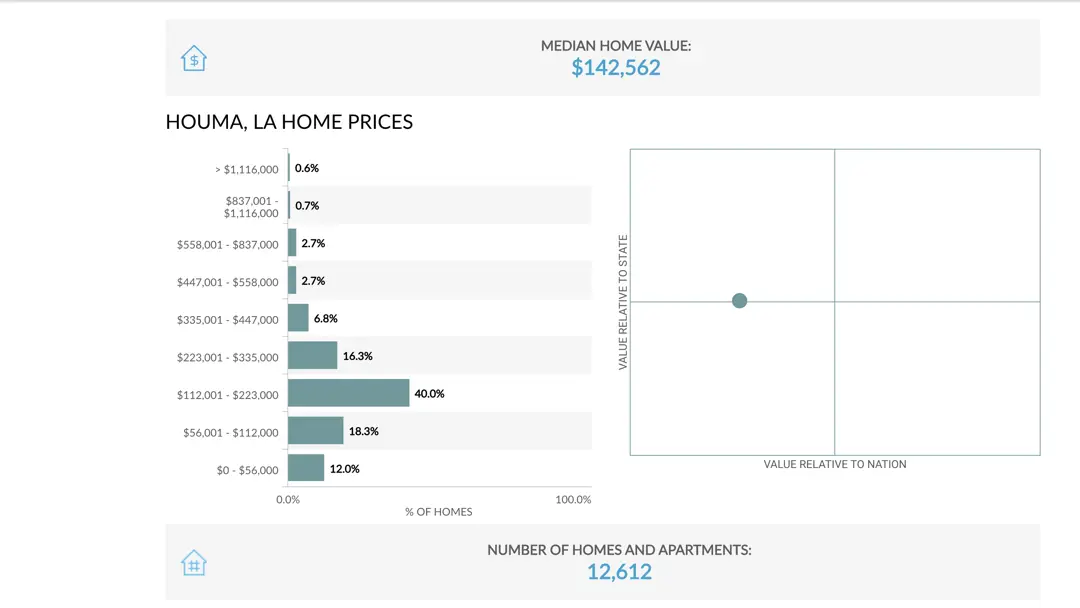

They should have an excellent working knowledge of your local real estate market.

You want to find a mortgage loan officer who has an excellent working knowledge of your local real estate market. They should know about the different neighborhoods, and what types of homes are available in each one.

They should also be familiar with the local economy and how it could affect your ability to get a mortgage.

For Example:

In the past week here in Houma, single-family homes in 70360 sold for $569,000 and spent 184 days on the market. In 70360, the inventory of 36 experienced a 6% relisting. The average price per square foot was $125.

By understanding the local housing market, your officer should be able to give you a good idea of what you can expect in the current market.

They should have a strong understanding of credit.

A loan officer should have a strong understanding of credit. They should also be able to:

Offer advice on credit repair if needed.

Let’s face it; not everyone has perfect credit. If your credit isn’t perfect, you’ll want to find a loan officer who can offer advice on credit repair. They should be able to help you improve your credit so you can get the best mortgage possible.

They should be able to offer advice on different mortgage options.

A good loan officer should be able to offer advice on different mortgage options. This includes both the type of mortgage and the terms of the mortgage.

They should be able to help you find the best mortgage for your needs.

A good loan officer will work with you to find the best mortgage for your needs. This includes finding a mortgage that fits your budget and needs.

Recap

So there you have it, some things to look for in a good loan officer. When shopping for a mortgage, be sure to find someone who meets all of the criteria above.

A good loan officer can make all the difference in getting a great mortgage.

Don’t settle for anything less than the best.

If you’re looking for a mortgage loan officer in the Houma, Louisiana area, I’m here to help. Give me a call or fill out the form below to get started.