Are you looking for a new home?

A jumbo mortgage may be the right option for you. Jumbo mortgages are larger than the conforming loan limit set by Fannie Mae and Freddie Mac.

This means that they are available for purchase by borrowers who need more than the typical conforming loan amount.

This post will unpack everything you need to know about jumbo mortgages, including the benefits and eligibility requirements.

What is a jumbo loan?

A jumbo loan is a mortgage used to finance properties outside the typical conforming loan limits. In most counties (or parishes for us here in Louisiana), the maximum amount for a conforming loan is $647,200, according to the Federal Housing Finance Agency (FHFA). A jumbo loan is required when a home’s price surpasses the local conforming loan limit.

Non-conforming conventional mortgages, or jumbo loans, are riskier for lenders since they can’t be guaranteed by Fannie Mae and Freddie Mac, which means the lender is not protected from losses in the case of a borrower’s default. Jumbo loans are generally available with a fixed interest rate or an adjustable rate, and depending on the loan length, they can come with a term of 10, 15, 20, or even 30 years.

What are the benefits of a jumbo mortgage?

A jumbo loan can be a good option for borrowers who don’t mind paying a higher interest rate and want to avoid the hassle (and cost) of getting private mortgage insurance (PMI). Jumbo loans also offer some flexibility that other loans don’t – like the ability to include a second home or an investment property in the same loan.

Another potential benefit of a jumbo mortgage is that you may not be required to get PMI, even if you’re putting less than 20% down. In most cases, lenders will require PMI for any loan with less than a 20% down payment. But with a jumbo loan, since the loan amount is higher than the conforming limit, you may not be required to get PMI.

Of course, every borrower’s situation is different, so it’s important to talk to a lender and compare your options to see what’s best for you.

Want to talk to a lender right now? Give me a call at 504-330-6448 and learn how you can get a jumbo mortgage.

Qualifying for a jumbo loan

Because jumbo loans are larger and riskier for lenders, underwriting criteria have become more stringent.

Here are some of the key qualifying factors:

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

Image Source: Investopedia

A strong credit score.

You’ll typically need a credit score of 700 or higher to qualify for a jumbo loan. So if your score is on the lower end, you may have a more challenging time qualifying.

A low debt-to-income ratio.

This is the percentage of your monthly pre-tax income that goes towards debts – like your mortgage, car payments, student loans, and credit card bills. For a jumbo loan, lenders typically like to see a DTI of 43% or lower. So if your DTI is on the higher end, you may need to work on lowering it before you can qualify for a jumbo loan.

I have seen lenders be more flexible if you have more cash reserves.

This leads us to…

Cash reserves

If you have a chunk of money in the bank, you’re more likely to get a jumbo loan. It’s not uncommon for lenders to require borrowers with jumbo loans to demonstrate that they have enough financial reserves for one year’s worth of mortgage payments.

Documentation

To prove to your lender that you have the income and assets to qualify for a jumbo loan, you’ll need to provide some additional documentation. This could include:

- Your most recent pay stubs

- W2 forms from the past two years

- Your tax returns from the past two years

- Bank statements from the past three months

- Proof of any other income, like investment income or rental income

- Proof of any assets, like stocks, bonds, and 401(k)s

- Your most recent mortgage statement (if you’re refinancing)

So make sure to have all of your documentation in order before starting the application process.

If you’re self-employed…

You may have a more challenging time qualifying for a jumbo loan if you’re self-employed. When you’re self-employed, your income can be more variable and harder to prove to a lender. So if you’re self-employed and thinking about getting a jumbo loan, make sure to talk to your lender about what documentation they’ll need to see.

Need to talk to a lender?

Call me at 504-330-6448 to find out how you can start getting the perfect loan for you!

Appraisals

Depending on the lender, you may also be required to get a second property appraisal. This is to ensure that the value of the home you’re buying or refinancing is equal to or greater than the loan amount. So if you’re planning on getting a jumbo loan, factor in the cost of an appraisal into your budget.

Now that we’ve covered the basics of jumbo loans let’s compare them to conforming loans.

Jumbo Loans vs. Conforming Loans

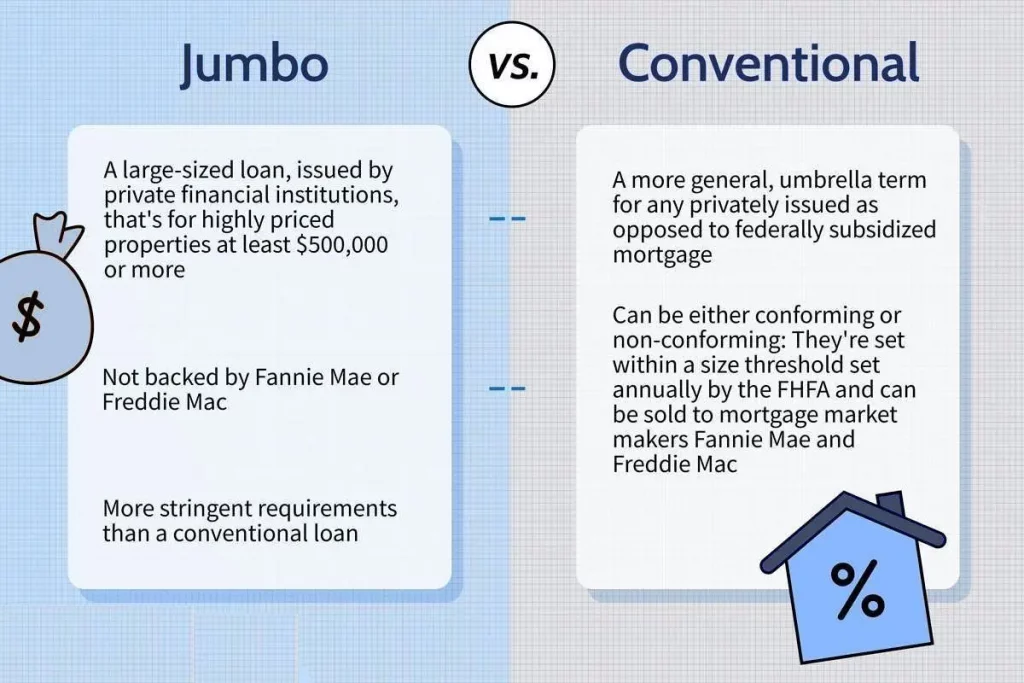

The difference between a jumbo mortgage and a conventional loan is the loan amount.

Conforming loans meet the guidelines set by government-sponsored enterprises like Freddie Mac and Fannie Mae. Jumbo loans, on the other hand, exceed these limits.

Some of the other factors that distinguish jumbo loans from conforming loans include:

Down payment requirements

You can typically put down as little as 3% when you get a conforming loan. But because government-sponsored enterprises don’t back jumbo loans, they usually require a higher down payment – although I’ve seen some lenders go as low as 10%. So if you don’t have a lot of money for a down payment, a conforming loan may be the better option.

Potentially higher interest rates

Jumbo mortgage rates are typically somewhat higher than conforming loan rates, depending on the lender and your financial circumstances.

However, many lenders can provide jumbo loan rates comparable to those on conforming loans — and some may even offer marginally lower interest rates based on market conditions, so don’t forget to shop around.

Higher closing costs and fees

Nothing surprising here. Because the loan amount is higher, you can expect to pay higher closing costs and fees. But just like with interest rates, it’s important to compare offers from different lenders to make sure you’re getting the best deal.

Loan limits

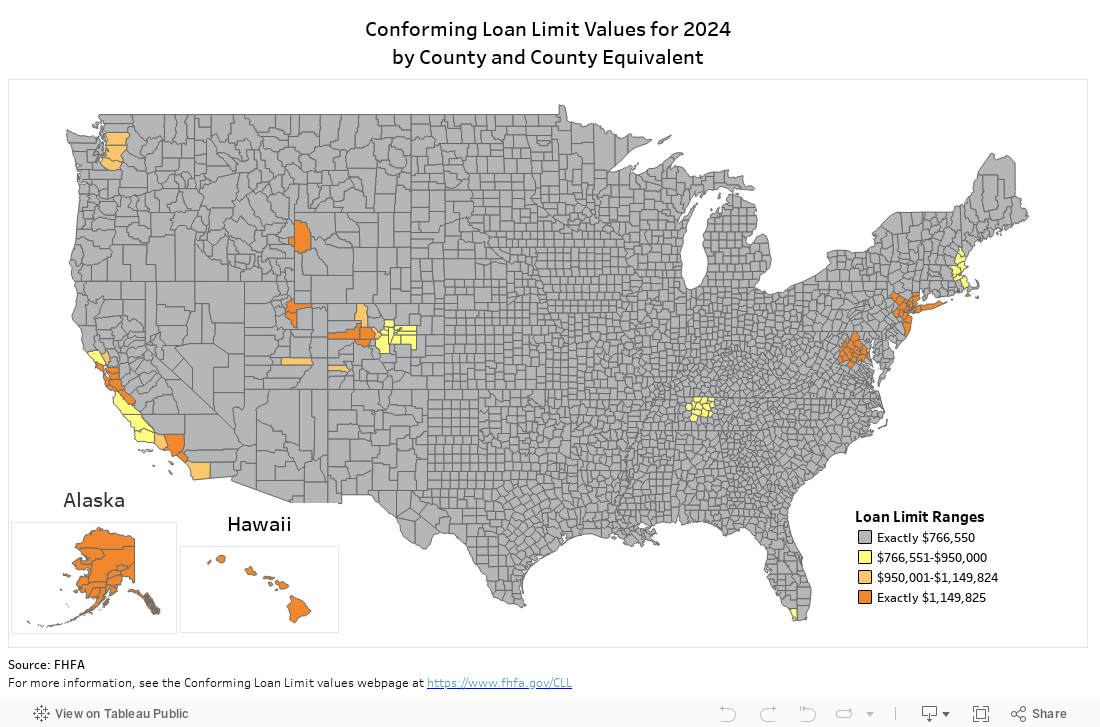

As mentioned earlier, the maximum loan amount for a conforming loan is $647,200 in most parts of the country. But in high-cost areas like Hawaii and Alaska, the limit is $726,525. So if you’re looking to borrow more than $484,350 (or $726,525 in high-cost areas), a jumbo loan may be the right choice.

Because some real estate markets are considerably more expensive than others, the maximum loan size for conforming loans varies by county or parish.

How do you know which category your county (parish) falls into?

Use the map below to see the maximum loan size in your area:

Is a jumbo loan right for you?

If you’re thinking about getting a jumbo home loan or have a few more questions, I can help. I have years of experience helping people finance their homes and over eight years in the business.

Give me a call at 504-330-6448, and I’ll be happy to answer any of your questions.

Or you can complete the loan application below to get pre-qualified for a mortgage:

I look forward to hearing from you!

-Renee Dupre, Mortgage Loan Officer

NMLS ID: 1936279

Equal Housing Lender

By submitting this form, you authorize me to contact you at the telephone number or email provided.