Reverse mortgages are a type of loan that can be helpful for retirees or people who are no longer working. With a reverse mortgage, you can borrow against the equity in your home, and you don’t have to make any payments on the loan as long as you live in the home. Here’s what you need to know:

What is a reverse mortgage, and how does it work?

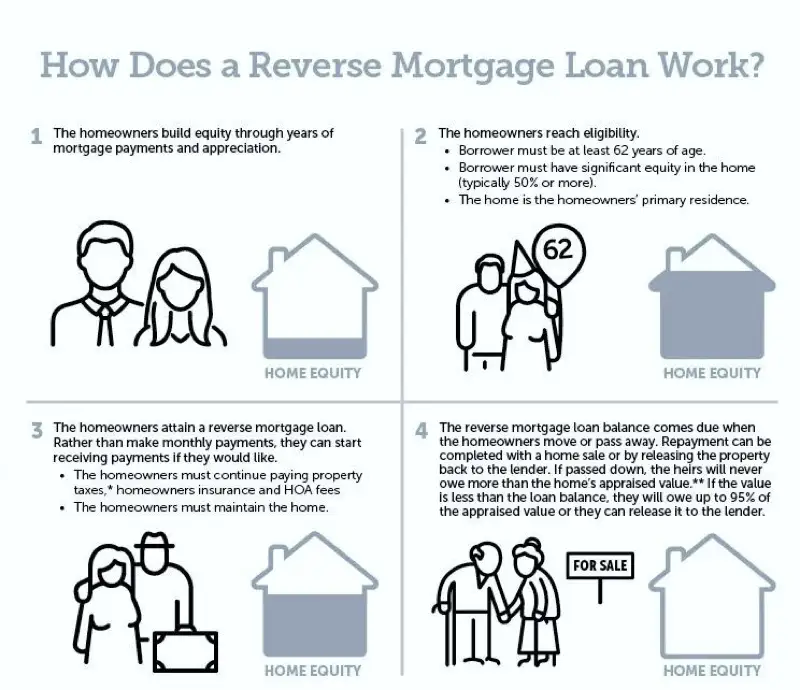

A reverse mortgage is a type of loan that allows you to borrow against the equity in your home. Unlike traditional mortgages, where you make monthly payments toward the amount you’ve borrowed, you don’t need to make any payments as long as you live in your home with a reverse mortgage.

Instead, the loan is paid off when the borrower dies or moves out of the house, and it can be used to provide financial security in retirement.

Who should consider a reverse mortgage?

A reverse mortgage may be right for you if you are 62 or older, are retired, or are no longer working, and you need some extra cash to help make ends meet. It can provide much-needed financial security in your later years, but it’s important to understand all the pros and cons before deciding whether it’s suitable for your situation.

Some of the factors that can affect your decision include how much equity you have in your home, whether you have other sources of income or savings, and your long-term plans for the home (such as selling or passing it down to family members).

Ultimately, a mortgage loan officer can help you assess whether a reverse mortgage is the best option for your needs, so it’s good to speak with one before moving forward.

Need to speak to a loan officer? You’ve come to the right place! I have the perfect loan for you. Contact me today, and we can discuss your situation and find the right loan for you.

How much money can you borrow with a reverse mortgage?

The amount of money you can borrow with a reverse mortgage depends on several factors, including the value of your home, your age, and how much equity you have in your home. In general, the older you are, and the more valuable your home is, the more money you will be able to borrow.

The only way to know for sure is to speak with a loan officer. So if you’re considering a reverse mortgage, don’t delay – visit the reverse mortgages page to learn more!

What are the fees associated with a reverse mortgage?

As with any loan, there are fees associated with a reverse mortgage. These include an origination fee, closing costs, and ongoing servicing fees. The lender charges the origination fee for processing the loan, and it can offer a variety of mortgage options for retirees and people who are no longer working.

Our experienced loan officers can help you assess your situation and decide if a reverse mortgage is right for you. To learn more, speak with one of our loan officers today.

Are there any risks associated with a reverse mortgage?

Yes, there are some risks to consider when considering a reverse mortgage. For instance, if you take out a reverse mortgage and then need to sell your home or move out for any reason, you may not have enough equity to pay off the loan and could end up owing money to the lender. Additionally, if you don’t make payments on property taxes or insurance, the lender could foreclose on your home.

Before taking out a reverse mortgage, it’s essential to understand all the risks and make sure you are comfortable with them. Speaking with a loan officer can help you decide. So if you’re thinking about a reverse mortgage, contact me today to get started!

Overall, a reverse mortgage can be a great way to secure your financial future in retirement. But it’s important to do your research and speak with an experienced loan officer before making any decisions – and that’s where I come in! Contact me today, and let’s talk about your situation so we can find the right loan for you.

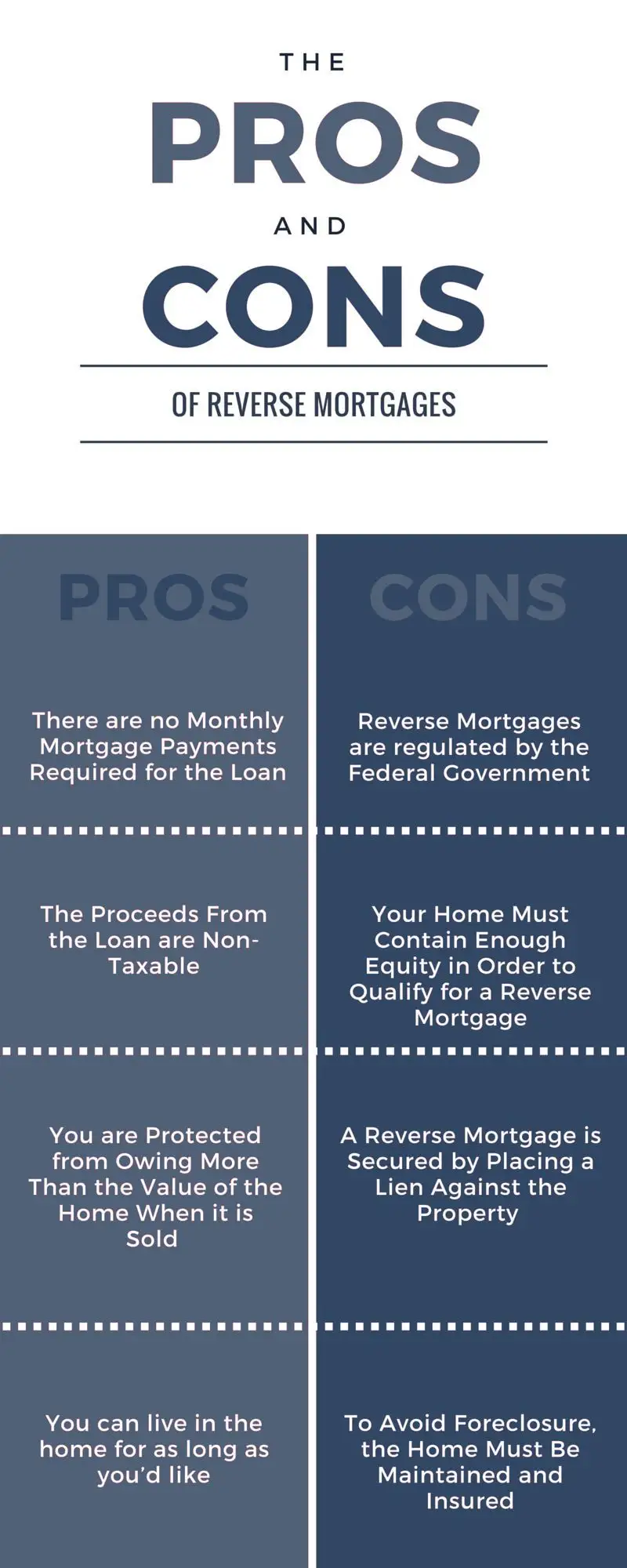

What are the Pros and Cons of a Reverse Mortgage?

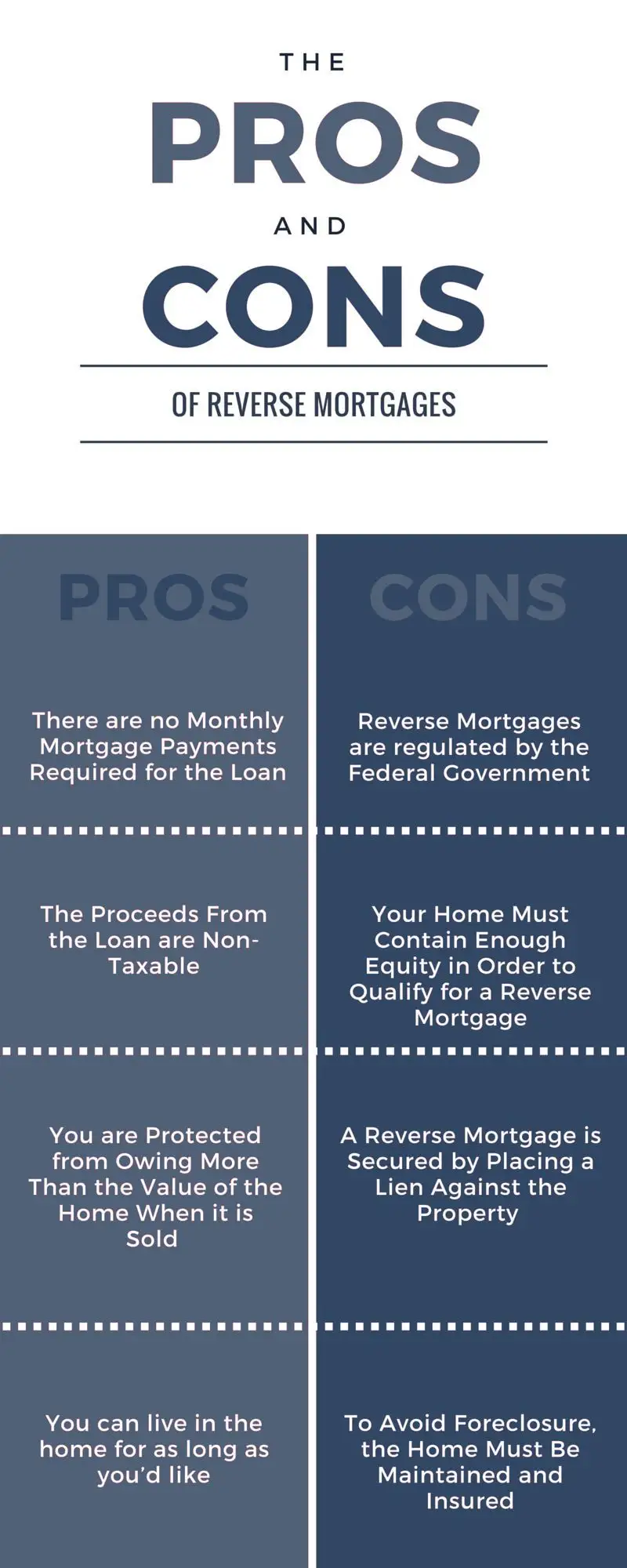

As with any home mortgage, there are pros and cons to getting a reverse mortgage. It’s important to understand all of the potential risks and benefits before deciding.

Pros:

- You don’t have to make any loan payments as long as you live in your home.

- The interest on the loan is usually tax-deductible.

- You can use the money from a reverse mortgage for anything you want, including home improvements, paying off debts, or supplementing your income.

Cons:

- The loan balance and interest continue to grow, so it can potentially reduce the value of your estate over time.

- If you move out of your home or go into a nursing home for more than 12 months, you could owe more on the loan than what it’s worth.

- If you or your spouse passes away, the loan must be repaid in full.

Generally, the best way to decide if a reverse mortgage is right for you is to speak with an experienced loan officer who can help you assess your situation and determine if the pros outweigh the cons. So if you’re considering a reverse mortgage, contact me today, and let’s talk about your options!

How can you qualify for a reverse mortgage?

To qualify for a reverse mortgage, you must meet certain age and property requirements. In most cases, borrowers must be at least 62 years old and own a home that is paid off or nearly paid off with relatively low maintenance costs.

Additionally, the home must be your primary residence and meet specific property standards.

If you think a reverse mortgage may be right for you, contact me today to discuss your situation and find out if you qualify. We’ll work together to help you decide if it’s the right option for securing your financial future in retirement. So don’t wait – get in touch with me today!

Get Pre-Qualified Now!

What are the types of reverse mortgages?

There are three types of reverse mortgages: single-purpose, federally insured, and proprietary.

Single-purpose

These loans are offered by local or state government agencies or non-profit organizations and can only be used for a specific purpose, such as repairing your home or paying property taxes.

Federally insured

Federally insured reverse mortgages are also known as Home Equity Conversion Mortgages (HECMs) and are backed by the US Department of Housing and Urban Development (HUD).

There are two types of HECMs: the standard HECM and the HECM for purchase. Standard HECMs can be used for any purpose, while HECMs for purchase can be used to buy a new primary residence.

Because the Federal Government insures these loans, they typically have lower interest rates and fees than proprietary loans.

Proprietary

These are private loans that are not backed by the government. They tend to have higher loan principal limits than federally insured reverse mortgages, but they may also come with more fees and restrictions.

If you’re considering a reverse mortgage, contact me today so we can discuss your options and find the best type of loan for you.

How to choose between a reverse mortgage and other types of loans, such as a traditional mortgage or an equity line of credit.

There are several factors to consider when deciding which type of loan is right for you, including your financial situation, how much money you need, and how long you will need it.

If you’re not sure which type of loan is right for you, contact me today, and I’ll help you compare different options and find the best solution for your needs. Let’s get started!

How to get a reverse mortgage loan

If you’re interested in taking out a reverse mortgage, the first step is to contact an experienced loan officer. I can help you assess your situation and determine if a reverse mortgage is right for you.

If it is, I’ll help you find the best loan option and walk you through the application process. So don’t wait – call me today, and let’s get started!

Conclusion

A reverse mortgage can be a great way to secure your financial future in retirement.

But it’s important to do your research and speak with an experienced loan officer before making any decisions – and that’s where I come in! Call me today at 504-330-6448, and let’s talk about your situation so we can find the right loan for you.