If you’re looking for a new home, budgeting is an essential step in the process. Here are a few tips to help you get started:

1. Make a list of your priorities.

What’s most important to you in a new home? Location? Size? Features? Write down your top priorities to help you narrow your search.

Size?

When it comes to size, be realistic about what you can afford. Consider how much space you’ll need. If you’re unsure, think about how you use your current home. Do you need a lot of storage space? Do you entertain often?

Keep in mind that the size of your home will also affect your monthly expenses, such as utilities and maintenance costs (we’ll get to that more later). So, if you’re looking for a home that’s easy on the budget, smaller may be better.

Location?

The location of your new home can also impact your budget. If you’re looking for a home in a desirable neighborhood, you may have to pay more than you would in a less desirable area.

Think about how much you’re willing to spend on transportation costs, too. If you’re looking for a home close to work or other activities, you may be able to save money on gas or public transportation costs.

Amenities

When it comes to amenities, again, think about your priorities. If you’re looking for a home with a pool or other luxury features, you may have to pay more upfront. But keep in mind that these features could also add to your monthly expenses (think: higher utility bills).

Some amenities may seem like a good deal at first, but they could cost you more in the long run. For example, A home with a pool may be appealing, but it will also require regular maintenance and could increase your homeowner’s insurance rates. So, be sure to do your research before making any decisions.

Once you know your priorities, you can start to calculate what you can afford.

2. Be realistic about what you can afford.

Start by looking at your monthly income and expenses. How much money do you have leftover each month after bills and other necessary expenses are paid? This is called your “disposable income.”

If you don’t have much disposable income, you may need to reconsider your home-buying budget.

It’s important to stay within your means when budgeting for a new home.

Just because you’re approved for a specific mortgage amount doesn’t mean you should spend that much. Stick to what you can afford so you don’t end up “house poor.”

Don’t be afraid to ask for help from family or friends if you need it.

Lean on the expertise of others to help you make the best decision for your budget.

3. Consider all the costs of homeownership.

When buying a new home, it’s important to consider all the associated costs, not just the monthly mortgage payment. Here are a few other expenses to keep in mind:

Maintenance and repairs:

As a homeowner, you’ll be responsible for maintaining your home and making any necessary repairs.

Set aside money each month to cover these costs. A good rule of thumb is to set aside 1-3% of your home’s value for maintenance and repairs each year.

For example, if your home is worth $200,000, you should budget $2,000-$6,000 each year for maintenance and repairs.

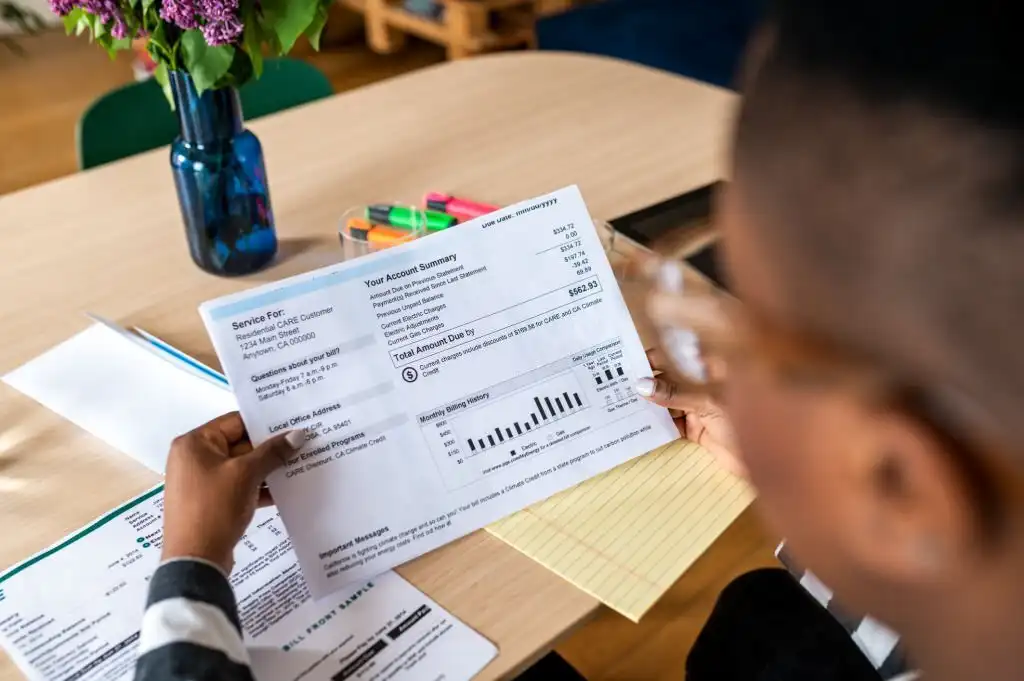

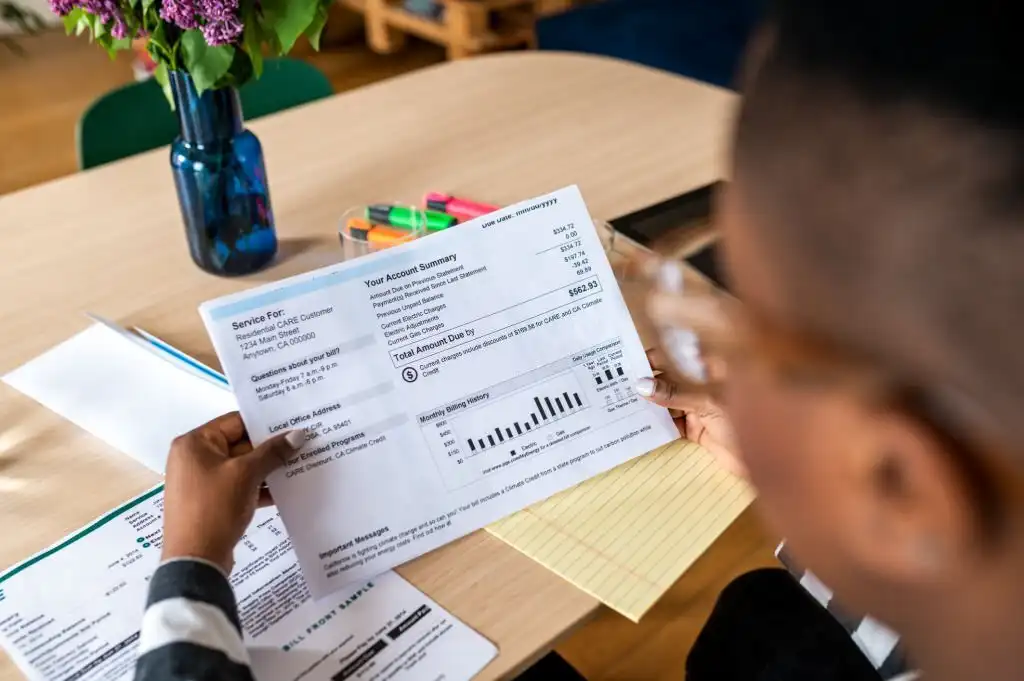

Utilities:

The cost of utilities will vary depending on the size of your home and the amenities you have.

If you’re not sure what to expect, ask the current homeowners for an estimate of their monthly utility bills. This will give you a good starting point for budgeting purposes.

Homeowner’s insurance:

Homeowner’s insurance is required if you have a mortgage.

But even if you don’t have a mortgage, it’s still a good idea to have coverage in an emergency.

Ask your real estate agent or lender for recommendations on homeowner’s insurance companies. They should be able to give you a few good options to choose from.

HOA Dues:

If you’re buying a home in a neighborhood with an HOA, you’ll be required to pay monthly or annual dues.

These dues go towards maintaining common areas, like pools or tennis courts.

Be sure to ask about HOA dues before making an offer on a home.

You don’t want to be surprised by hidden costs after making the purchase.

Property taxes:

Property taxes are based on the value of your home and are usually collected by your municipality.

The amount you’ll pay in property taxes each year will vary depending on where you live.

For example, homeowners in New York City pay some of the highest property taxes in the country.

So, if you’re considering buying a home in NYC, be sure to factor this cost into your budget.

Now that you know what to expect, you can start shopping for the home of your dreams!

5. Speak to a Mortgage Loan Officer

I can help you with that.

You’re looking to buy a new home but don’t know where to start.

It’s hard to know who to trust when getting a mortgage. There are so many lenders and loan officers out there. How can you be sure you’re getting the best deal?

Contact me, and I’ll help you sort through the options. I’ll find the right mortgage loan for you and make sure the process is as smooth as possible.

I’m a Mortgage Loan Officer with over eight years of experience right here in the Houma, LA area. I’ve helped countless people like you get the home of their dreams.

You don’t have to go through this process alone. Call me today at 504-330-6448 and let me help you find the perfect mortgage loan for your new home.

Get pre-approved for a mortgage.

Once you know how much you can afford to spend on a new home, it’s time to get pre-approved for a mortgage.

Getting pre-approved means that a lender has reviewed your financial information and is willing to give you a loan for a certain amount of money. Complete the form below to get started today.